Cannabis Banking and Business remains a crucial topic for both cannabis consumers and entrepreneurs navigating a growing yet fragmented industry. In a market where state legalization surges ahead but federal restrictions persist, understanding how cannabis finance works is essential. Whether you’re buying your preferred strain or launching a dispensary, success starts with financial literacy, regulatory awareness, and strategic planning. This comprehensive guide explores banking options, raising capital, staying compliant, and managing cash flow in today’s cannabis economy.

Why Cannabis Banking and Business Is Still Complex

Despite 38 U.S. states legalizing medical cannabis and 24 approving recreational use by 2024, federal laws still categorize cannabis as a Schedule I substance. This creates major roadblocks for cannabis businesses seeking traditional banking services. Many banks avoid working with cannabis-related businesses (CRBs) due to potential federal penalties or money laundering charges.

This disconnect forces dispensaries and other CRBs — whether offering products like calming Blue Dream flower or high-potency live resin — to operate largely in cash. Without bank accounts, loans, or credit card processing, they face heightened risks, payroll hurdles, and growth limitations.

Advocacy groups such as the Minority Cannabis Business Association and Americans for Safe Access push for improved access to finance. Yet meaningful change depends on federal reform efforts like the SAFE Banking Act, which remains stalled in Congress. Recognizing these limitations is the first step in mastering cannabis banking and business realities.

Current Banking Options for Cannabis Businesses

While federal barriers remain, some local and regional financial institutions — particularly credit unions — are stepping up to serve the cannabis industry. These banks operate under strict state guidelines and follow robust compliance procedures to manage risk while supporting legal cannabis operations.

Examples include Partner Colorado Credit Union, which offers cannabis businesses deposit accounts, online bill pay, armored cash pickups, and business training programs. In California and Oregon, banks such as Safe Harbor Financial and Maps Credit Union also provide cannabis-specific services.

Enrolling with these institutions usually requires:

- Comprehensive ownership and financial documentation

- Monthly compliance reviews and financial audits

- Monthly service fees ranging from $500 to $2,000+

So, when a customer purchases a 10mg THC chocolate edible or a GMO Cookies eighth, their dispensary likely navigated complex cannabis banking and business requirements just to accept that transaction securely.

How Cannabis Companies Raise Capital

Starting any business requires capital — and that’s doubly true in cannabis. With traditional loans unavailable due to federal law, many cannabis operators turn to private funding sources to build infrastructure, stock inventory, and retain staff.

Common funding options include:

- Private Equity and Venture Capital: Targeted toward large, multi-state operators (MSOs), especially in emerging markets like New York or Michigan

- Angel Investors: A fit for niche startups such as edibles brands, solventless labs, or terpene-driven delivery services

- Convertible Notes: Debt-to-equity instruments enabling early-stage investment before valuation is finalized

- Crowdfunding Platforms: Particularly accessible to hemp-derived and CBD product brands under certain regulations

However, investors usually demand high returns and strict controls. For entrepreneurs — especially social equity applicants in California, Illinois, or Massachusetts — grants and state-level assistance can reduce the dependency on costly external funding, helping create a more balanced cannabis banking and business ecosystem.

Improving Financial Management in Cannabis

With banking access limited and cash transactions dominant, disciplined financial planning becomes vital. Dispensaries unable to accept credit cards often depend on cash, cashless ATMs, or platforms like Hypur and Aeropay.

To navigate this landscape, cannabis entrepreneurs should:

- Hire a Cannabis CPA: Professionals with IRS Code 280E knowledge help minimize tax risk and optimize reporting

- Use Seed-to-Sale Software: Programs like METRC and BioTrackTHC automate compliance, inventory, and traceability by product type and potency

- Create a Rolling Budget: Anticipate seasonal dips, licensing delays, or supplier shortages with proactive budgeting

- Stay Compliant with Track-and-Trace: In states like California, noncompliance affects finances — from suspended licenses to payment processor bans

Whether selling full-spectrum tinctures or terpene-heavy strains like Durban Poison (25% THC), sound cannabis banking and business practices form the operational foundation.

The Compliance and Insurance Connection

In the cannabis space, compliance isn’t optional — it’s central to success. Businesses must follow local zoning laws, uphold state licensing, and meet ongoing testing standards. These rules directly influence financial decisions and the ability to secure reliable insurance.

Essential coverage types in cannabis banking and business include:

- General Liability: Important for in-store safety and slip-and-fall protection

- Product Liability: Protects against potential health claims from edibles, oils, or topicals

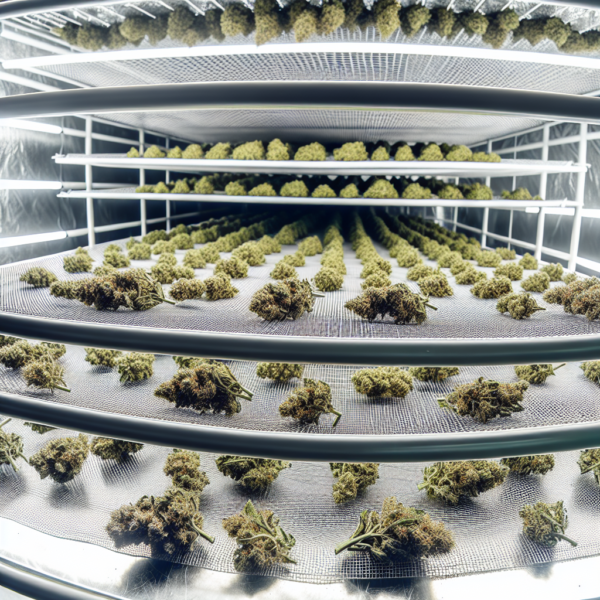

- Crop Insurance: Covers indoor cultivators growing sensitive strain varieties like Sherbert and Zkittlez

- Cybersecurity Coverage: Essential for brands managing customer data and loyalty programs

Insurance providers often review a cannabis business’s banking setup as part of underwriting. In essence, compliant cannabis banking and business infrastructure makes a company insurable — allowing for safe scaling and legal growth in a volatile market.

Creating a Fairer Cannabis Financial Future

The future of cannabis banking and business depends largely on federal reform. Legal protections and expanded access to banking will empower dispensaries to accept mainstream payments, provide transparency for medical patients, and allow entrepreneurs to scale without unfavorable investor terms.

Consumers play a powerful role too. By supporting compliant, transparent dispensaries — those with terpene labeling, licensing info, and partnerships with social equity brands — they help legitimize the entire industry. Meanwhile, entrepreneurs should continue learning through CPA networks, state marijuana associations, and policy advocacy groups.

Cannabis banking and business challenges may persist, but progress is undeniable. With informed planning, ethical operations, and financial transparency, both consumers and businesses can elevate the cannabis industry toward long-term compliance, accessibility, and equity.